Retail customers and businesses are opting for cheaper means of shipping their letters, packages and freight, even if it means waiting for a few extra day. In the past few years, there has been a general shift in preference towards lower shipping options. E-commerce players will likely shift to USPS given its lower rates, leading to a decline in UPS and FedEx's market share.Į-commerce businesses are looking for alternative options to reduce costs Therefore, a reduction in rates by USPS, followed by an increase in rates by UPS and FedEx, will lead to USPS' rates being significantly lower than that of UPS and FedEx. However, we believe that FedEx's Ground segment revenue per package is somewhat in line with that of UPS' Ground service. Ground service revenues are gross figures, whereas SmartPost revenues are reported net of postage paid to USPS. The combination leads to reduced overall revenue per package since reported revenues are lower. FedEx's Ground segment comprises of two services - Ground and SmartPost (SmartPost utilizes USPS' services to make final delivery). Presently, USPS generates revenue per package of $7.60 from its Priority Mail services. This compares to $7.96 for UPS' Ground service. FedEx's revenue per package for its Ground segment cannot be directly compared to UPS or USPS. The reduction is expected to lead to a 30-50% decline in rates for weight categories most used by e-commerce players, which ranges from 6-20 pounds.

#USPS PRICING LIST 2014 PLUS#

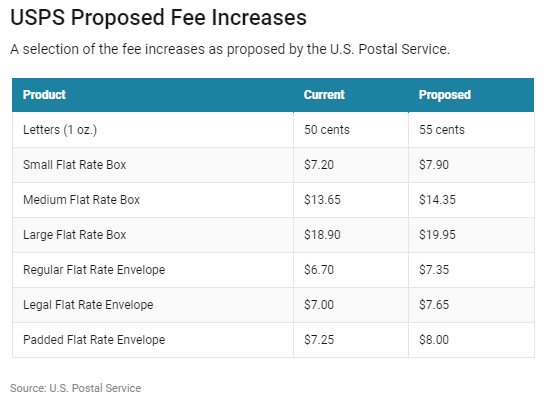

USPS reduced prices for its Priority Mail Commercial Plus and Commercial Base services by 2.3% and 0.9% respectively. However, USPS decided to go the other way. Most of the regional and local players were expected to follow the change in pricing mechanism. e-commerce package delivery, the price increase was expected to go unchallenged and their market shares unhindered. Since both, FedEx and UPS, had announced the change in pricing mechanism at relatively the same time, and since they are the dominating players in the U.S. Dimensional pricing would lead to better price realization and help in improving margins. The change in pricing mechanism is expected to lead to a 30-50% increase in rates for package shipment. The reason behind the change in pricing mechanism was that e-commerce packages were generally light in weight but high in volume, and therefore occupied larger space in trucks, leading to depressed margins. UPS and FedEx had recently announced a change in pricing mechanism for their ground segment (the segment that largely caters to e-commerce packages), from weight based to dimension based, in order to realize better price for the packages delivered ( Click here to read our article). e-commerce package delivery business with volume share of approximately 54%, 30%, and 16% respectively between themselves. UPS, FedEx and USPS are the major players in the U.S.

0 kommentar(er)

0 kommentar(er)